It easy for us to switch our insurance provider every year, and so insurers are sensitive to consumer pressure. A new report from Campax, the Swiss campaign group, assesses and ranks the climate policies of the main insurers on the Swiss market so that consumers can make an informed choice.

Insurance companies are managing climate risks and started warning about climate change more than 50 years ago. They are some of the biggest investors in the global economy and without their insurance cover, most new fossil fuel projects could not go forward. Insurers are thus in a strong position to influence future energy and climate sector developments.

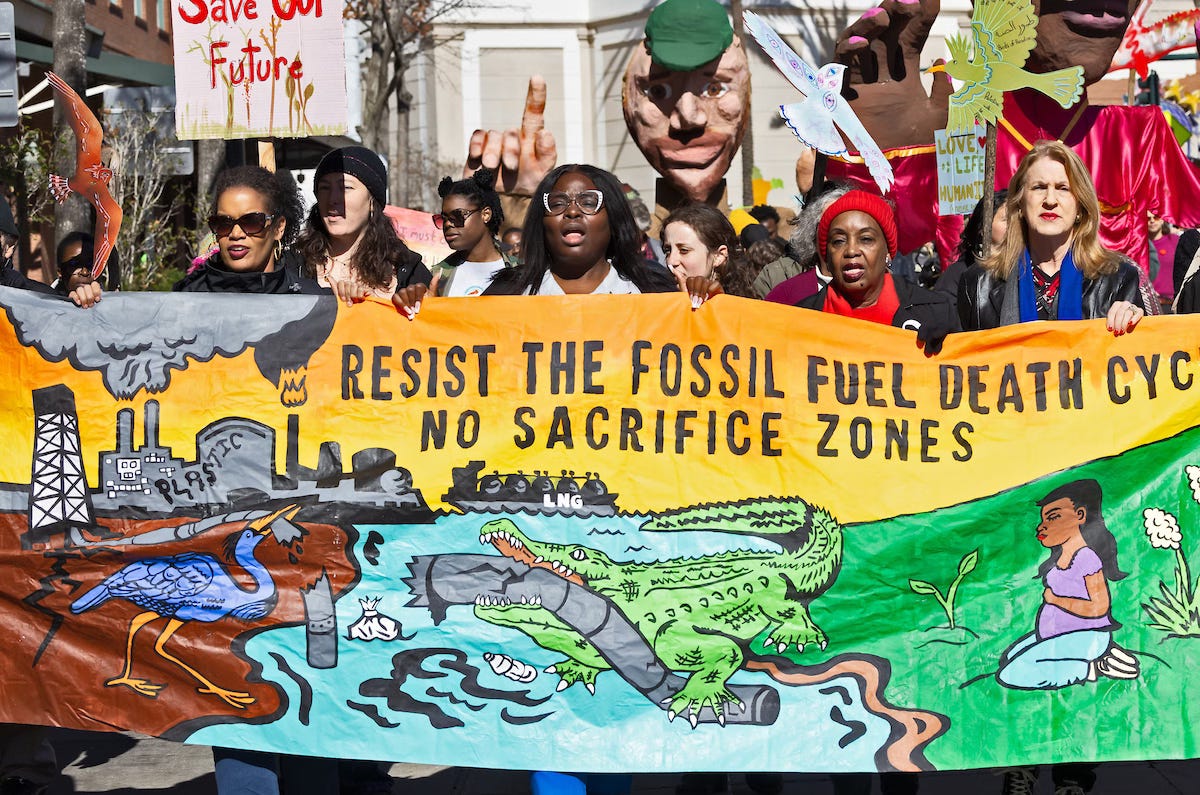

Most insurance companies ruled out support for new coal projects in recent years but when it comes to oil and gas, progress has been much slower. Even insurers which like to present themselves as climate leaders such as Allianz, AXA, Zurich, Helvetia and Swiss Re have for example insured the disastrous Calcasieu Pass liquefied fossil gas (LNG) terminal on the Gulf of Mexico.

The new report which Campax (on whose board I sit) just published assesses and ranks the climate policies of the eight insurers which dominate the Swiss non-life insurance market: Mobiliar, AXA (headquartered in France), Zurich, Helvetia, Allianz (from Germany), Baloise, Vaudoise and Generali (from Italy). Reinsurance companies, which don’t have retail customers, were not covered in the report.

The main findings of the report are as follows:

· In spite of their public commitments, no insurance company active on the Swiss market has aligned their business with a pathway limiting global warming to 1.5°C.

· With a score of 6.4 out of 10, Generali ranks highest among the insurers on the Swiss market. The Italian carrier is the only major insurance company which has not only restricted cover for new oil and gas extraction projects, but also for mid- and downstream projects such as pipelines, LNG terminals and gas-fired power plants.

· Allianz, Zurich and AXA – the other insurers with a global brand to defend – figure next on the Campax ranking. They have adopted restrictions on new coal and on oil and gas extraction projects, but not yet on gas pipelines, LNG terminals and the like.

· Insurers which are only or predominantly active on Switzerland’s domestic market score lower for their insurance restrictions. Other than Helvetia, they are not – or no longer – insuring large commercial energy projects.

· Helvetia ranks high on their investment but low on their insurance policies. They no longer invest in companies which are expanding their oil and gas production but will still insure the projects and operations of the same companies – an embarrassing internal contradiction.

Campax encourages consumers to reach out to their insurance companies, inform them about the new report and ask them to rule out support for any new fossil fuel projects. If they don’t take action within a few months, consumers can switch their provider when the next policy renewal comes around. After all, it is public pressure which has brought about the partial progress in moving insurers away from fossil fuels so far.

Image credit: Julie Dermansky, Campax