Generali the first insurer to drop new gas pipelines and power plants

With so many grim climate developments from around the world, I’m happy to share some positive news even if it arrives not from a Swiss actor but from a global actor with a major role in Switzerland.

Climate scientists have told us at least since 2021 that we have no space left for any new coal, oil or gas projects if we want to keep global warming to a somewhat manageable level. Without insurance, most new fossil fuel projects cannot go forward and so insurance can be an effective lever to accelerate the shift from fossil fuels to clean energy.

In response to campaign pressure and growing climate risks, at least 45 insurers have stopped insuring new coal mines and power plants, and such projects have become uninsurable in most of the world. Oil and gas offer a bigger revenue stream than coal, so the same insurers have resisted shifting away from this sector. Most major European and Australian insurers have adopted some restrictions on oil and gas, but unlike in the coal sector only for upstream projects (exploration and extraction), not for mid- and downstream projects (pipelines, LNG terminals, refineries, gas power plants etc.). Most US and Asian insurers have not adopted any restrictions on insuring new oil and gas projects.

In this context it is great news that Generali announced last week that it would stop insuring not just new oil and gas extraction projects, but also mid- or downstream projects of companies they consider transition laggards. The policy’s limitation to transition laggards is unfortunate in that any company which still develops new oil and gas projects should be considered a climate laggard. Even so it’s positive that the world’s first major insurer has restricted its support for new pipelines, LNG terminals and gas power plants.

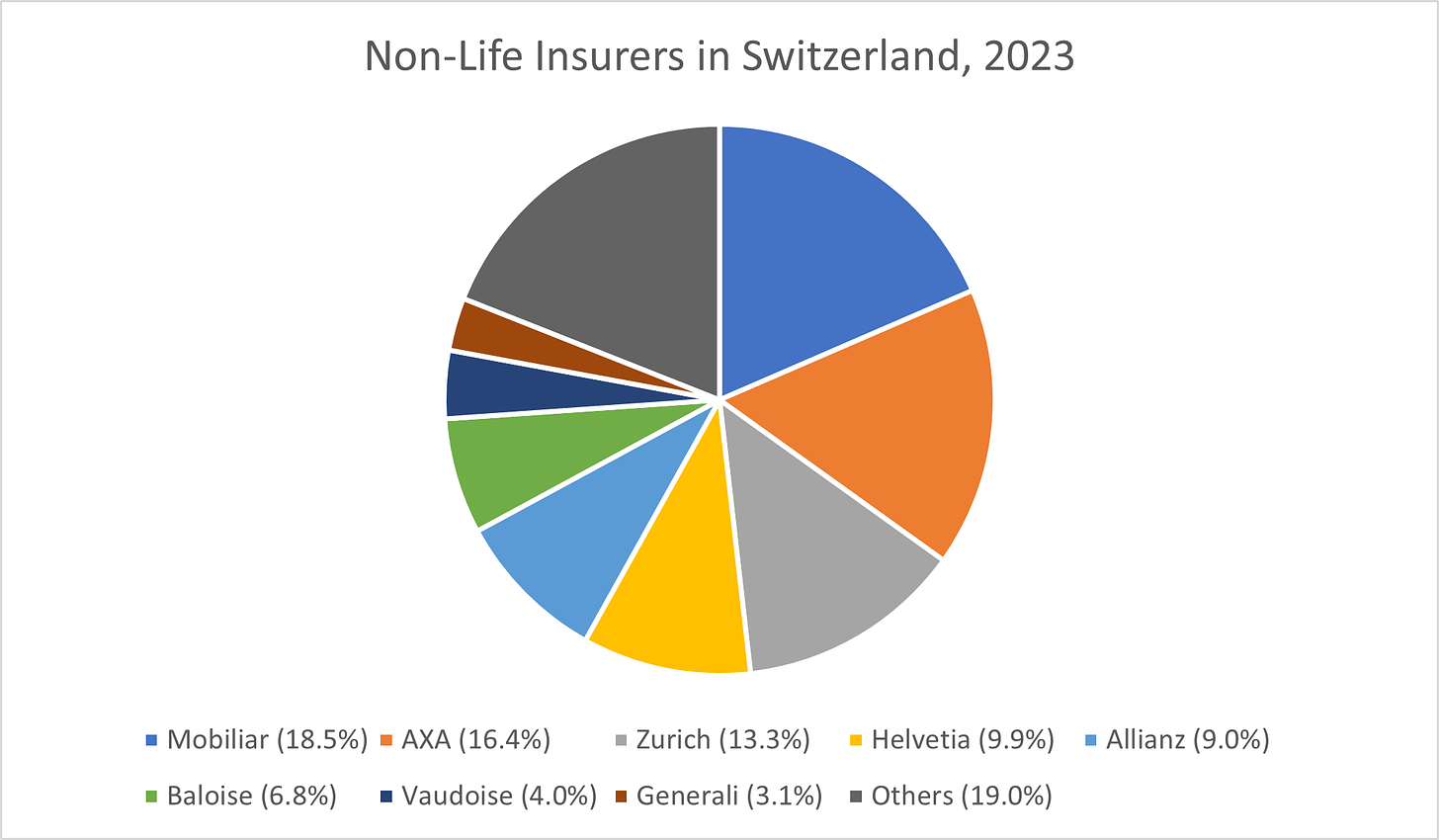

Generali is the third-largest non-life insurer in Europe and the eight-largest in Switzerland. In case you’re wondering, here is what the other major insurers on the Swiss market are doing about oil and gas:

· Mobiliar, Baloise and Vaudoise are only active within Switzerland and thus very unlikely to insure new oil and gas projects.

· Other than Generali, Allianz has the strongest oil and gas restrictions among the insurers on the Swiss market. They will no longer insure new upstream projects and new mid- and downstream oil projects (like oil pipelines or diesel power plants). They are however still underwriting new mid- and downstream gas infrastructure.

· AXA and Zurich no longer insure new oil and gas exploration and extraction projects but continue to underwrite mid- and downstream projects in both subsectors. Helvetia has stopped insuring new tar sands and other extreme oil projects but is the only Swiss insurer which continues to insure new conventional oil and gas projects without any restrictions.

In a response to Generali’s announcement, the Insure Our Future campaign welcomed the new policy for setting “the highest standard among global property and casualty insurers”.

When AXA was the first insurance company to stop insuring new coal projects in 2017, other major players quickly followed. Now that Generali is restricting its support for new pipelines, LNG terminals and gas power plants, Allianz, AXA, Zurich and other major insurers should follow suit as well. Send Generali a friendly note if you’re one of their customers and consider the role of your insurer in fossil fuel expansion when your next renewal opportunity comes up!